Financial Statements & Presentations

1. Basic Policy on Information Disclosure

Japan Asia Investment Co., Ltd. (hereafter JAIC) discloses its corporate information promptly, accurately and in an equitable manner from the viewpoint of shareholders and investors, and strives to maintain the trust of the capital market in the company.

2. Standards for Information Disclosure

JAIC discloses information in accordance with the Companies Act, the Financial Instruments and Exchange Act, and other laws and regulations, as well as rules on the timely disclosure as defined by the Tokyo Stock Exchange (hereafter "Timely Disclosure Rules"). The company discloses information promptly in accordance with the standards specified under the Timely Disclosure Rules except when the information falls within the scope specified under the Timely Disclosure Rules as having little impact on shareholders' or investors' investment decisions (hereafter "Minor Impact Criteria").

In addition, the company actively discloses any other information it judges as helpful to enhance understanding of shareholders or investors.

The company does not disclose any information whose confidentiality must be maintained, including personal information and types of information whose disclosure may infringe rights of interested parties.

3. Method of Information Disclosure

JAIC discloses Information which is subject to the Timely Disclosure Rules (hereafter "Timely Disclosure Information") through the TDnet, a timely disclosure system provided by the Tokyo Stock Exchange., pursuant to the rules. In general, the released information will be promptly uploaded to the website of JAIC. In addition, JAIC strives to release any other information except the Timely Disclosure Information through its website etc., to reach shareholders and investors accurately and equally.

4. Handling of Non-public Information and Fair Disclosure

JAIC defines any non-public Timely Disclosure Information and non-public information on final financial results as "Material Information," and strives to maintain an information management structure to ensure equitable disclosure of information, aiming to prevent Material Information from being disclosed preferentially to selected shareholders, investors or equity analysts (hereafter "Parties Involved in Transactions").

Specifically, as specified in 8. (4) "Timely Disclosure Structure," the person in charge of handling information, the department in charge of information disclosure and other relevant departments assess the importance of the information and discuss whether there is the need to disclose it, after which the person in charge of handling information or a decision-making body within the company decides details of what should be disclosed.

5. Quiet Period

To prevent leaks of financial results before the announcement and secure fairness, JAIC defines the three weeks until the release of quarterly financial results as a quiet period. During the quiet period, JAIC does not answer inquiries or make any comments on business results. However, even during the quiet period, JAIC discloses Timely Disclosure Information pursuant to the rules.

6. Result Forecast and Forward-looking Statements

The private equity investment business conducted by the JAIC Group is significantly affected by changing factors such as stock markets, given the characteristics of the business. In addition, it has been difficult to forecast results reasonably in the rapidly changing environment in recent years. Therefore JAIC doesn’t disclose the results forecast. For the convenience of investors and shareholders, however, JAIC discloses “result forecast consolidated under the Previous Accounting Standard” even though it doesn’t have enough rationality.

The “result forecast consolidated under the Previous Accounting Standard” and any other forward-looking statements those JAIC announces are based upon the information available to JAIC at the time of announcement and certain assumptions. The achievement is not promised. Various factors could cause actual results to differ materially from these forward-looking statements.

JAIC issues the above cautionary statement whenever it discloses Forward-looking Statements, including "result forecast consolidated under the Previous Accounting Standard."

JAIC does not endorse any forecast, etc. of its earnings by a third party that is based on the third party's judgment. JAIC may, however, point out any significant misunderstanding of facts or error in such forecast.

7. Policy on Uncertain Information

JAIC does not comment on any uncertain information about the company, including publicly circulating speculations. However, if JAIC judges that the circulating information may have a material impact on the capital market and that there is the need to clarify the truthfulness of it, the company may make a public statement, treating it as information falling under the scope of Timely Disclosure Rules, after consultation with the stock exchange.

8. Internal structure

JAIC strives to promote constructive dialogue with Parties Involved in Transactions through the internal structure and efforts, as described below.

(1) Assignment of Director in Charge of Dialogue

JAIC assigns its representative director and president as the director who has general oversight of dialogue with Parties Involved in Transactions and ensures constructive dialogue is maintained.

(2) Coordinated Internal Structure to Support Dialogue

JAIC's departments respectively in charge of investor relations, corporate planning, general affairs, treasury, finance and legal affairs all belong to the same group, functioning organically together under the leadership of the executive officer in charge.

(3) Feedback Including Opinions Learned Through Dialogue

Opinions learned through dialogue are reported, as necessary, by the person in charge of investor relations to the person registered with the stock exchange as in charge of handling information and the representative director and president. The person registered with the stock exchange as in charge of handling information and the representative director and president may report to the board of directors, if they decide doing so is necessary.

(4) Timely Disclosure System

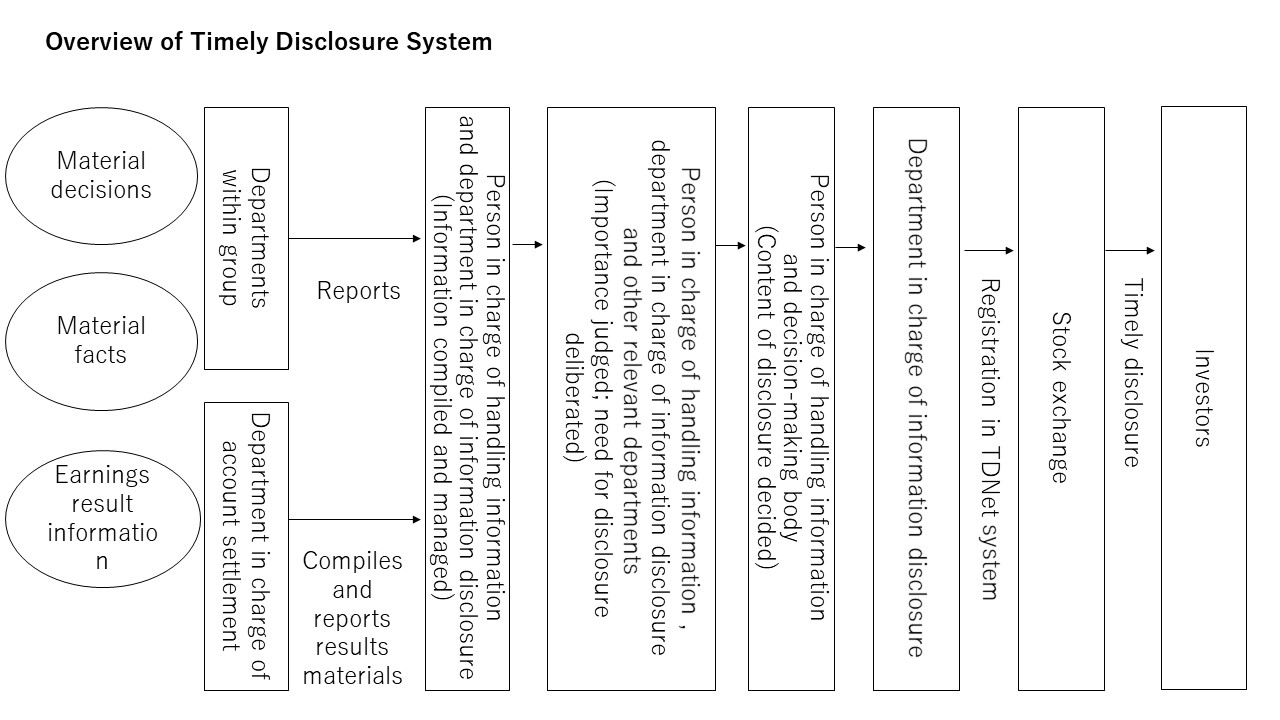

JAIC has an internal operational structure to ensure timely disclosure, as illustrated in the diagram below.

Timely disclosure is made upon approval by the person in charge of handling information, after related departments, the person in charge of handling information and the department in charge of information disclosure assess the importance of the information and discuss whether there is the need to disclose it. The person in charge of handling information may, however, seek approval from a decision-making body on the disclosure of the information if the person in charge of handling information decides doing so is necessary. Furthermore, any information on earnings results of the company is compiled and disclosed by the department in charge of information disclosure upon approval by the board of directors.