Business

Business Portfolio

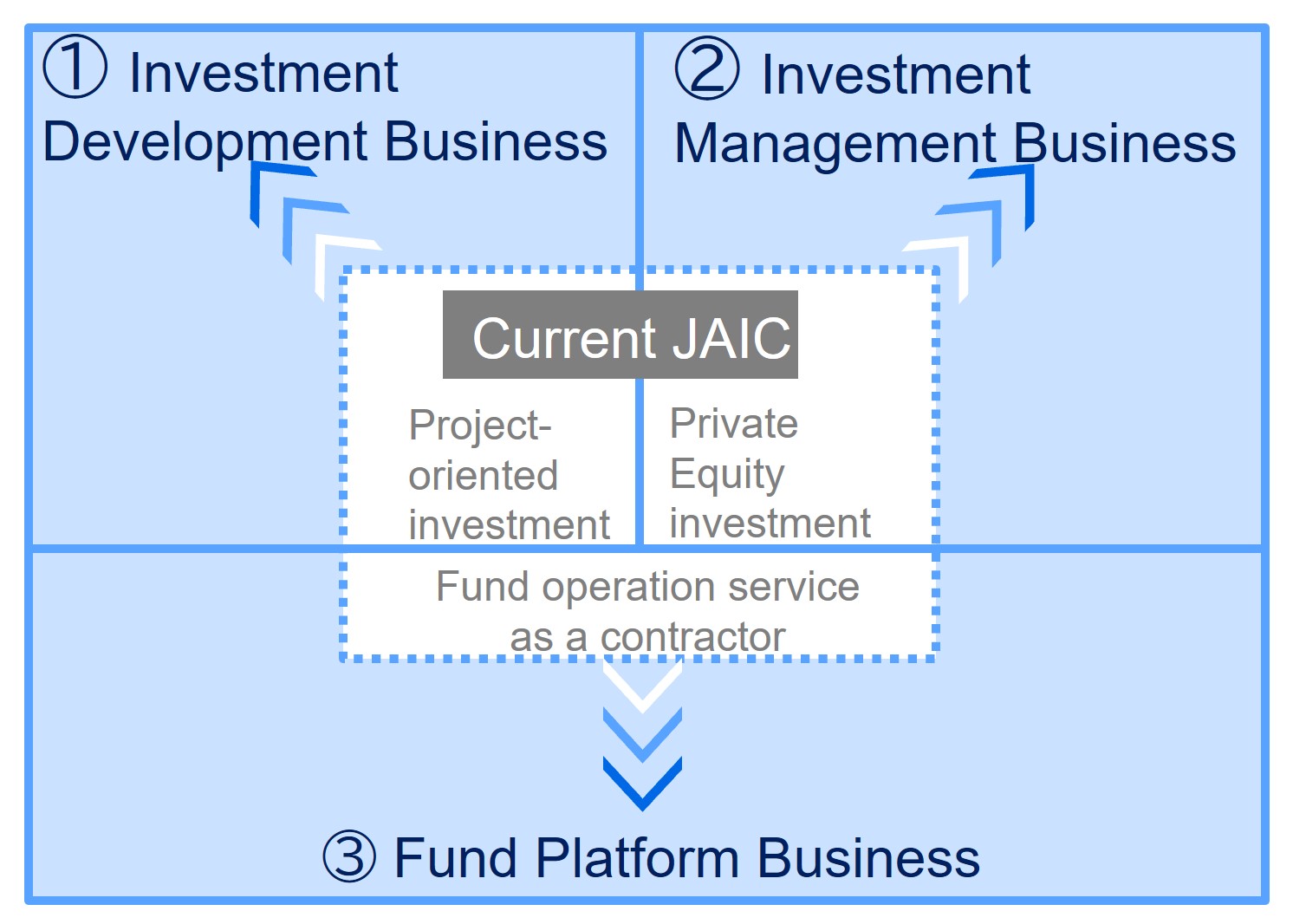

Investment Development Business

This is an investment business targeting Special Purpose Companies (SPCs) that own tangible assets. We provide finance by raising investment funds through private equity funds or loans.

After constructing the operational assets, we either operate or sell it. We invest in private tangible assets that are less affected by inflation and economic trends. The main investment targets are follows;

Energy: Renewable energy power plants, storage facilities

Infrastructure: Logistics facilities

Healthcare: Group homes for people with disabilities

Business opportunities

Due to rising energy costs and shortage of labor force, uncertainties continue around rises in interest rates and the economy in general, those projects are attracting attention as private real assets with inflation-hedging features and defensive features. They could be strong diversified investment targets for investors. They also could contribute to achieving responsible investment goals.

Investment Management Business

This is an investment business targeting various securities issued by corporations.

Leveraging our company’s strengths, we form funds to engage in buyout investments and PIPEs targeting traditional assets such as listed stocks and bonds. Additionally, we invest in alternative (non-traditional) assets. We conduct venture investments and buyouts in unlisted companies as well.

Business opportunities

In the current environment, where interest rates and inflation are rising and economic growth is increasing, there are profit opportunities in investing in traditional assets such as listed securities. Additionally, Japan's current economic environment—marked by a bail out from deflation, a weakening yen, and its growing importance as a production and research hub amid U.S.-China tensions—has drawn attention from overseas. Particularly, it has become an era where Asian investors are seeking investment opportunities in promising Japanese technology, venture companies, and listed firms.

- Details of Investment Management Business

- Investee Companies Achieving IPOs

- Key Funds Under Management

Fund Platform Business

JAIC Business Service Co., Ltd. (JBS) holds a long-standing track record as a fund administrator and provides customers with solutions for the middle- and back-office fund operations.

Solutions provided by JBS

Founded more than 20 years ago, JBS has been providing contract operational service to various customers, leveraging the skills and experience that have been accumulated over a long time as the back-office unit for the funds managed by the JAIC Group.

- Accounting operation for the fund

Bookkeeping, create fund business reports and financial reports, calculate success fees and dividends, interact with audit firm in times of accounting audit, etc.

-Management of fund assets and proxy service for general operations

Cover such operations as opening of deposit accounts for the fund, procedures for crediting/debiting funds, procedures for foreign remittances, opening and managing securities transaction accounts, etc.

Cover such operations as making of seals, etc., for the fund, seal placement for proxy letter, etc., creation and delivery of documents and certificates to each equity investor of the fund (LP), etc.

-Support for fund operator (GP) duties

Provide accurate advice and support based on the JAIC Group’s operational experience as GP.

Provide support for the establishment and liquidation of a fund, responding to inquiries from LPs concerning accounting, conducting procedures for transfer of LP position or withdrawal, creation of legally mandated reports, etc.

Features of JBS

-Accurate judgment based on JAIC Group’s experience in fund management operations

-Support for funds investing overseas

-Robust information security system

-Attentive support by dedicated staff